Mandatory remote learning a school or childcare closure for cleaning or other coronavirus. You will have to check your state unemployment website for details but for example in New York rules have been updated to allow workers the opportunity to work part-time while collecting regular Unemployment Insurance UI and Pandemic Unemployment Assistance PUA benefits.

Department Of Labor And Workforce Development Eligible Workers Set To Receive 300 Supplemental Unemployment Payments Nj Labor Dept Announces

BRAC New Jersey 4 replies Unemployment extensions for part time workers New Jersey 5 replies.

Nj unemployment for part time workers. To determine the amount of unemployment benefits youre eligible to receive your. Under NJ state law employers must provide up to 40 hours of paid earned sick leave per year to most full- and part-time employees including migrant and seasonal employees. Heres what we do know about unemployment benefits college students and part-time workers.

Can I receive unemployment as an adjunct professor from a NJ college and still work my part-time position in NY. How we calculate partial Unemployment Insurance benefits. Seasonal employees may face different rules for overtime and unemployment than regular year-round workers.

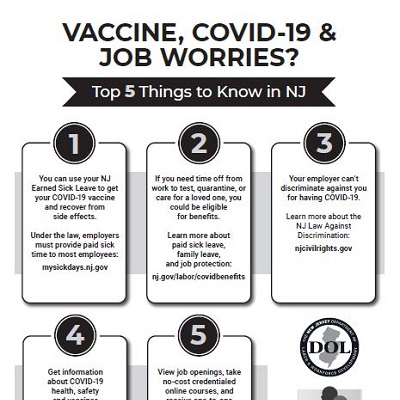

New Jersey has among the most comprehensive Temporary Disability Family Leave Insurance and Earned Sick Leave laws in the country which cover all types of workers full-time part-time temporary and seasonal. April 28 2017 at 245 am. Are workers compensation benefits taxable.

The partial unemployment regulations of New Jersey unemployment compensation laws aim to extend protection to those who may not have no work at all but still experience a loss of work. This video explains how you may be eligible to receive partial unemployment benefits if your hours have been reduced or you are working part-time. Workers compensation benefits are not taxable as per the NJ Gross Income Tax law NJSA 54A6-6.

In New York you have to work less than four days a week and earn 504 or less in that work thats the maximum unemployment payment in New York in order to still receive partial benefits. Its designed for those who might lose a full-time job but can find only a part-time job to replace it. Your states rules and the amount of money you earn help determine whether or not you can receive an unemployment check.

April 28 2017 at 406 am. Most state unemployment departments will consider part-time employment in your work history when figuring your benefits. How States Figure Benefits.

How many weeks of benefits can I receive Federal expanded and extended unemployment benefits ended September 4 2021. My benefits are ending. The amount youre earning through part-time employment will usually be subtracted from this figure.

Anyone wishing to receive unemployment benefits must report his weekly earnings and verify he is available and actively looking for full-time employment. As of January 18 2021 New York State has implemented a new rule that redefines how part-time work impacts unemployment benefits. Are other resources available See links to assistance with food housing child care health and more.

Google Translate is an online service for which the user pays nothing to obtain a purported language translation. NYS uses a partial unemployment system uses an hours-based approach. In addition there are instructions on the paper form.

In that case for each day you work your weekly benefit will drop by one quarter. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. For most year-round jobs part-time status is defined as less than 35 hours per.

You apply for your benefits as someone who is totally unemployed. Federal laws that expanded Unemployment Insurance benefits to more workers expired September 4 2021. I work for a charter school in NJ.

A citizen of New Jersey who qualifies to receive unemployment benefits but works part-time receives partial benefits after filing his weekly benefits claim online or by phone to his local claim center. Federal Work Study Jobs Are Not Eligible. NJ employers of all sizes must provide full-time part-time and temporary employees with up to 40 hours of paid sick leave per year so they can care for themselves or a loved one including for COVID-19 testing illness quarantine or vaccination.

You do have to claim part-time wages while you are on unemployment -- and the requirements ARE listed on the paper form for New Jersey as well as the online form for New Jersey. Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period. For example if you worked a 40-hour.

For those who lose their full-time work and must work part-time hours its possible to collect unemployment for the loss of work. It also covers you if your employer reduces your hours or pay significantly. Division of Unemployment Insurance.

Where do I collect unemployment New Jersey 2 replies Helpcannot find any info regarding unemployment in new jersey for those who work only part time New Jersey 1 replies Can I collect NJ unemployment due to loss of income. When you claim your weekly benefit you will let us know if you worked that week. To be eligible for partial benefits you cannot work more than 80 percent of the hours normally worked in the job.

For example in New York you can work up to seven days a week without losing unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. We will ask how many hours you worked and how much you earned gross for that week. Seasonal employment in New Jersey is defined as work that is performed or 36 weeks or fewer per calendar year and is based on seasonal need or local draw.

See our memo you can provide your employer on the COVID-19 vaccine and NJ Earned Sick Leave. Since you already have a part-time job in hand please call the Unemployment Office to ascertain eligibility. Yes a claimant may be eligible for partial unemployment benefits while working part time due to lack of work.

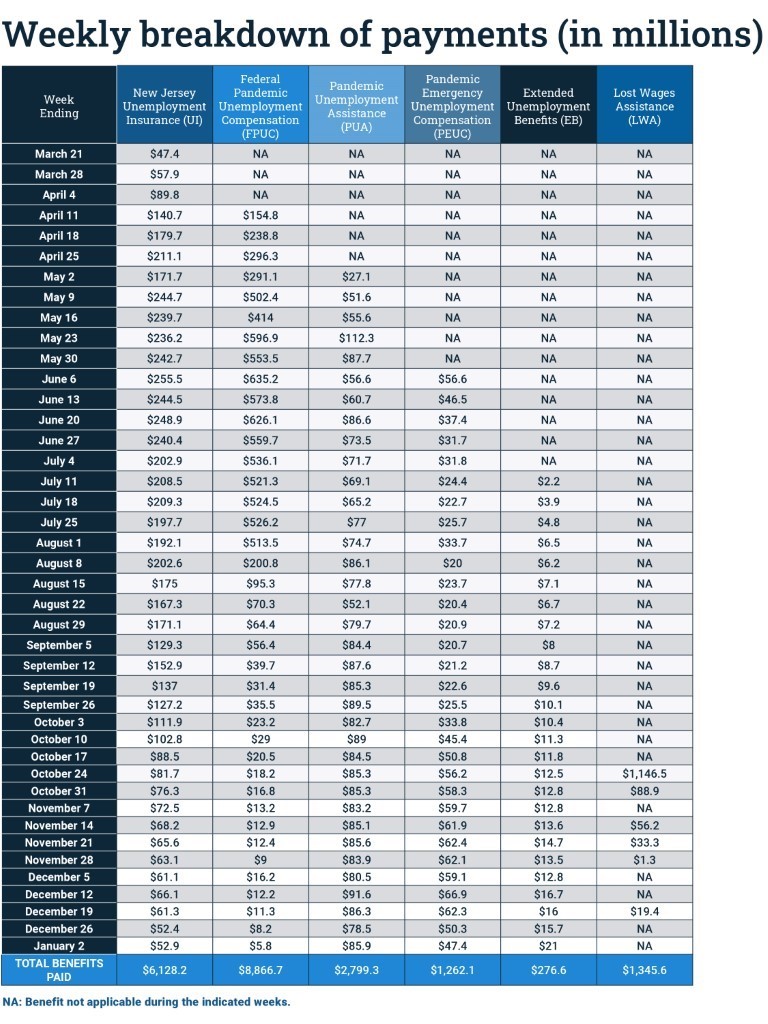

However the workers weekly benefit amount will be reduced dollar-for-dollar for all earnings in excess of 20 of the workers full weekly benefit rate. Since you were injured on your part time job any workers compensation benefits will be based on that employment. Additionally on July 1 2020 New Jerseys high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits if they meet among other requirements the minimum earnings.

The user is on notice that neither the State of NJ site nor its. There are more than 600000 students around the country who are part of the federal work study program in which the federal government subsidizes some of their pay as part of a financial aid package. Can use accrued Earned Sick Leave.

The department of labor calculates your weekly benefits and deducts the amount you. This change makes New Yorks partial unemployment system fairer and more equitable for New Yorkers who have the opportunity to work part-time while collecting regular Unemployment Insurance UI and Pandemic. Then you report the amount of money earned each week when you certify for benefits.

Nj Unemployment Delays For 75k Workers Should Be Resolved By Feb 12

New Jersey Unemployment Tips Hotel Trades Council En

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

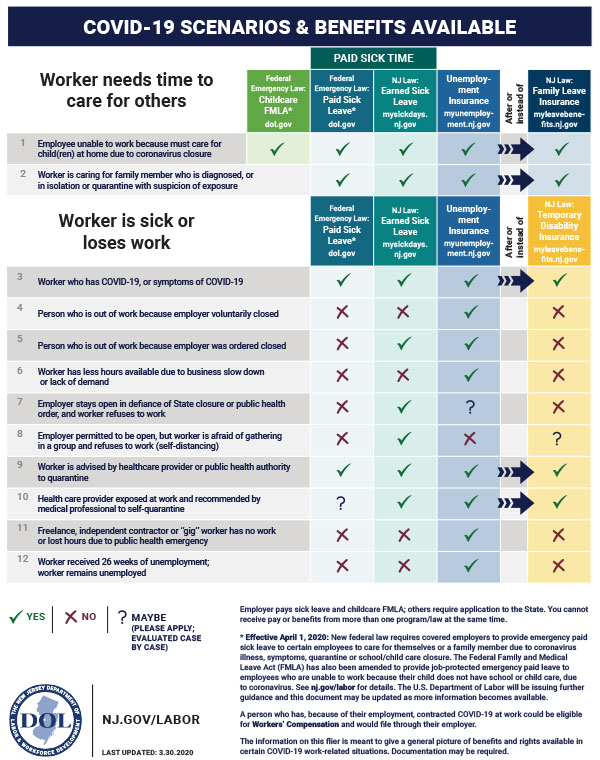

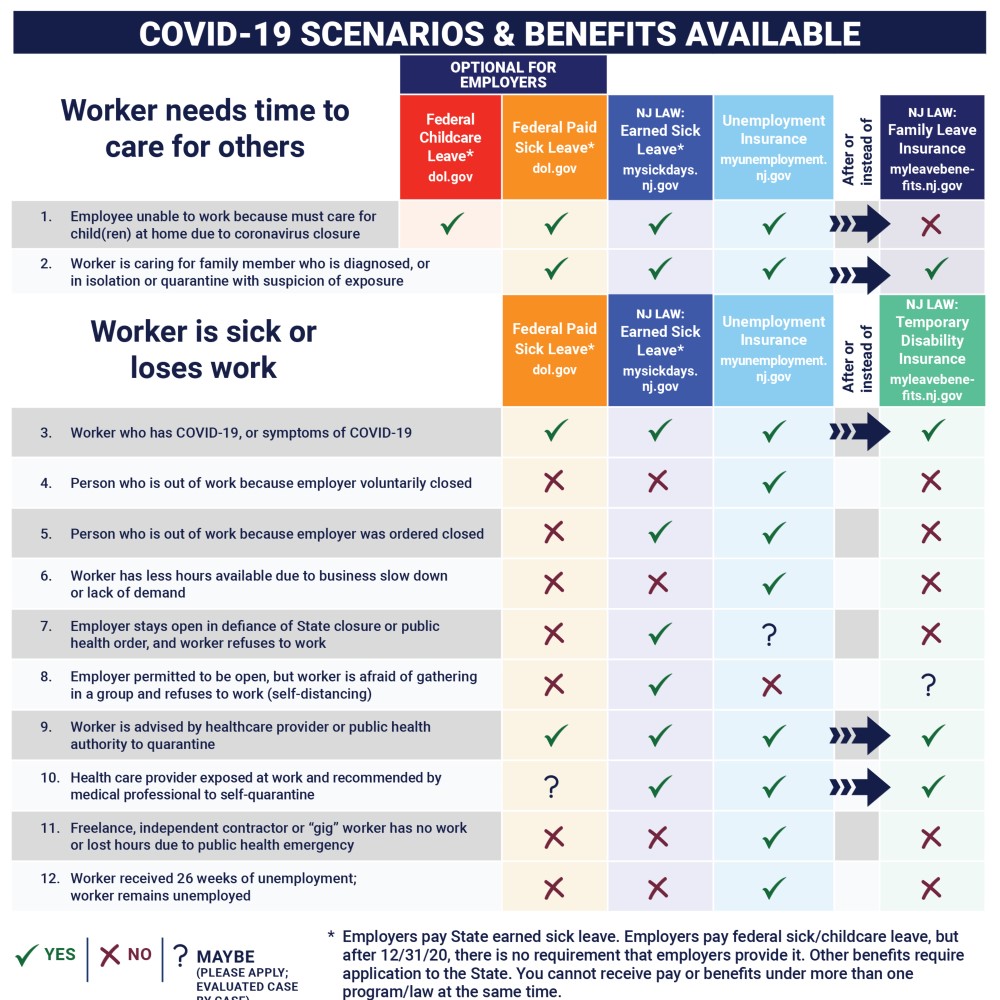

Division Of Unemployment Insurance Worker Benefits Protections And The Coronavirus Covid 19 What Nj Workers Should Know

The 600 Unemployment Booster Shot State By State The New York Times

The 600 Unemployment Booster Shot State By State The New York Times

Nj Unemployment 300 Benefit To Come To Workers Starting Next Week

Department Of Labor And Workforce Development Covid 19 Worker Benefits And Protections

Women S Earnings In New Jersey 2019 New York New Jersey Information Office U S Bureau Of Labor Statistics

Lsnjlaw An Overview Of The Unemployment Appeals Process

The 600 Unemployment Booster Shot State By State The New York Times

Resources For Employers And Job Seekers Camden County Nj

How Our Unemployment Benefits System Failed The New York Times

Division Of Unemployment Insurance Worker Benefits Protections And The Coronavirus Covid 19 What Nj Workers Should Know

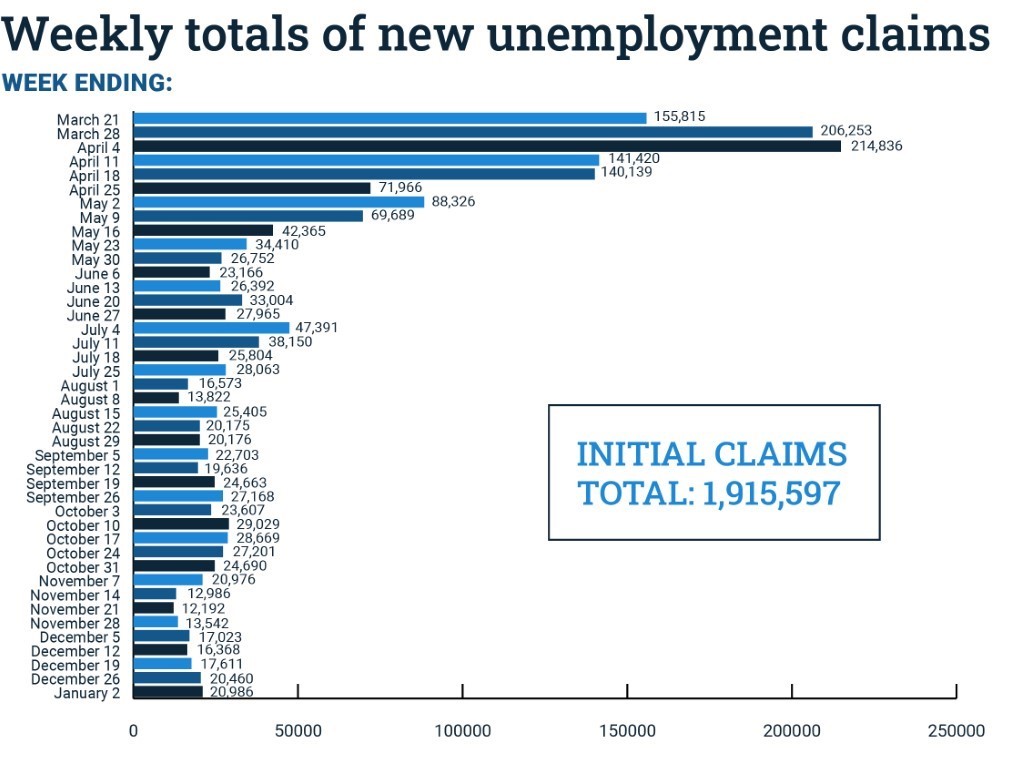

Njdol Eligible Workers Set To Receive 300 Supplemental Unemployment Payments

Coronavirus Can A Person Work Part Time And Still Collect Ui Benefits

Post a Comment

Post a Comment